When conducting international trade, and in some instances also domestic payments, you might have come across the terms “SWIFT code” and “BIC code”. We give you a thorough overview and explain how people and businesses can conduct international transactions with and without the SWIFT / BIC code.

What is a SWIFT code?

The term “SWIFT code” is usually referred to when it comes to international payments, for instance, when sending money from Europe to the US or the other way round. SWIFT allows you to make cross-border payments and to send currencies different from your home currency.

The SWIFT network connects more than 11,000 institutions and facilitates international transfers between issuing and remitting banks. However, a direct bank transfer is only possible if there is a direct commercial relationship between those 2 institutions, i.e. the banks keep Nostro/Vostro accounts of one another.

Most of the time, banks don’t have direct commercial relationships. In this case, the SWIFT network creates an “itinerary”, which consists of up to 3 intermediary banks, before the money reaches the receiving bank. Due to the cross-border nature and the amount of banks involved, fees are typically higher compared to other payment schemes, while the processing time is considerably longer.

For a SWIFT transfer, you’ll typically need:

-

- Recipient’s full name

- Recipient’s account number

- Payment reference

- Recipient bank’s BIC (SWIFT) code (if applicable)

- Bank’s name (if applicable)

- Bank’s ABA code (if applicable)

BIC code vs SWIFT code: What’s the difference?

When talking about BIC code vs SWIFT code, there is actually no difference between these numbers. While SWIFT stands for “Society for Worldwide Interbank Financial Telecommunications”, BIC means “Bank identifier code”.

When banks require the SWIFT code, they usually refer to international payments through the SWIFT network. In some instances, however, banks might ask you for the BIC code in order to identify the recipient’s bank for local transactions.

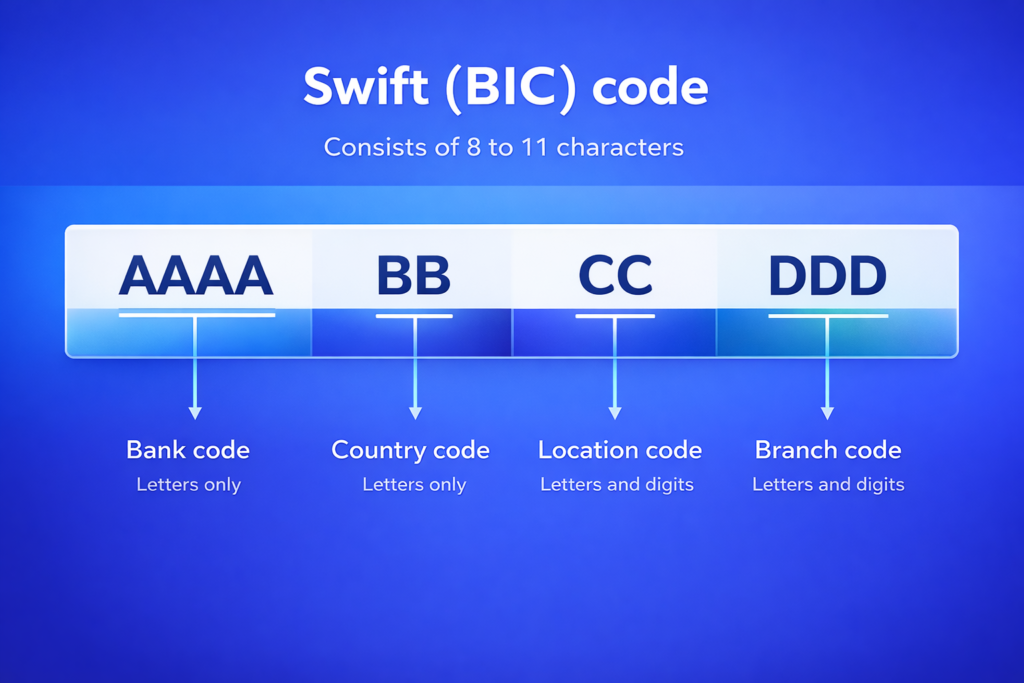

The layout for SWIFT vs BIC is exactly the same: Both codes have 8 to 11 characters. The first 4 consist of the bank code, followed by 2 characters for the country code and location code respectively. The last 3 characters display the branch code.

SWIFT vs IBAN

Besides BIC code vs SWIFT code, there are other ways to conduct an international money transfer, most notably through the SEPA network. The SEPA (Single Euro Payments Area) network is an initiative developed by the European Union and European countries to create a unified system for euro-denominated bank transfers and direct debits.

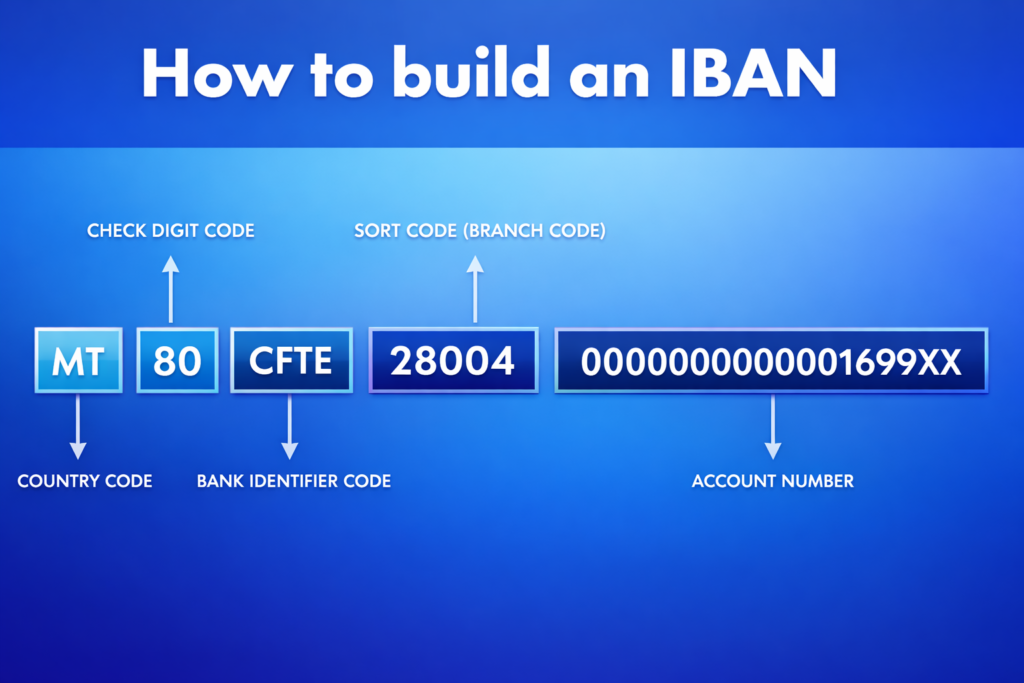

It allows for electronic payments across 36 European countries (including the 27 EU member states, along with Iceland, Liechtenstein, Norway, Switzerland, Monaco and San Marino). IBANs (International Bank Account Numbers) are primarily used in countries that participate in the SEPA network. They provide a standardised format for bank account numbers, making it easier to process and verify transactions across different countries.

For a SEPA payment, you’ll typically need:

-

- Recipient’s full name

- Recipient’s account number (IBAN)

- Payment reference

- Recipient bank’s BIC (SWIFT) code (if applicable)

SWIFT vs ABA routing number

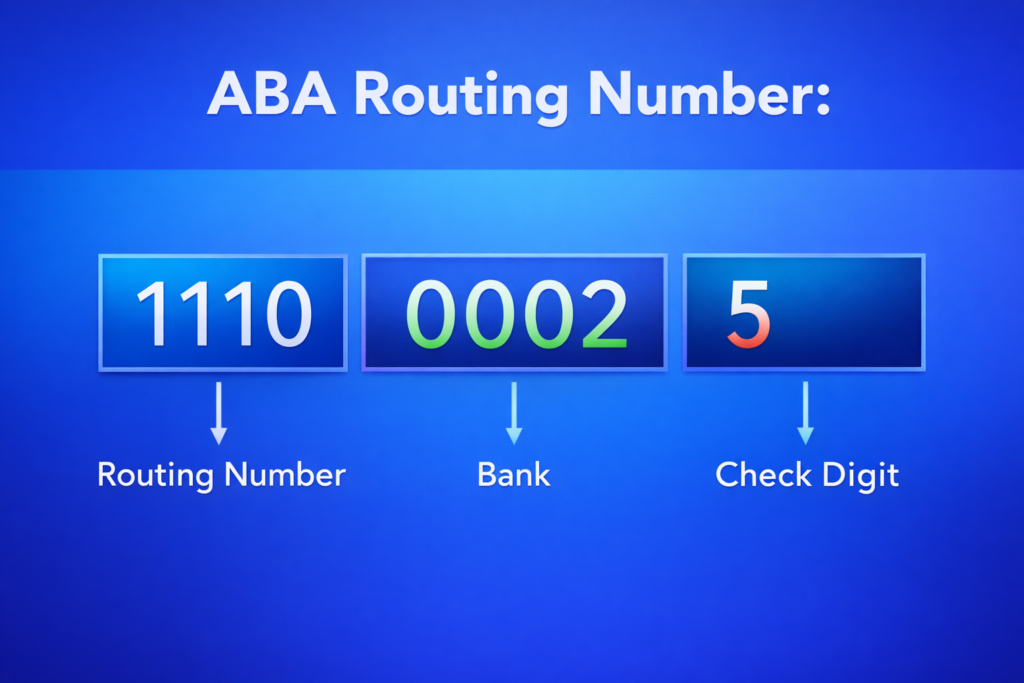

While SWIFT serves as an identifier for international bank transfers, the scope of the ABA routing number is much narrower. An ABA routing number, also known as a routing transit number (RTN), is used to identify financial institutions within the United States and is commonly used for paper and check transfers.

ABA routing numbers refer to the American Bankers Association and were first introduced in 1910. They consist of 9 digit numerical codes and typically begin from 00 to 12. While “00” is reserved for the United States Government, 01 to 12 correspond to the 12 Federal Reserve Banks. The first 4 digits make up the routing number, followed by another 4 digits for the bank identifier as well as the last number as a check digit.

SWIFT alternatives

Now that you know that BIC and SWIFT codes refer to the same identifier, you have everything you need to make international transactions.

The problem: SWIFT transactions are by far the most expensive and time-consuming way to conduct international bank transfers. As many intermediary banks are usually involved in the payment process, fees stack up, which can be either shared by sender and recipient or borne by one party.

In order to avoid these costly fees and to streamline cross-border transactions, you should first evaluate the following payment methods before sending money abroad.

Online payment systems

Online payment systems, such as amnis, offer a cost-efficient and easy alternative compared to SWIFT. amnis enables you to conduct cross-border transactions while making use of local payment schemes such as SEPA in Europe or ACH in the United States, resulting in much less transaction fees and time compared to the SWIFT network. If your suppliers and business partners also use amnis, you can even make use of real-time P2P transactions, which are completely free of charge. It is also possible to set up a foreign currency account to hold and trade with over 20 currencies.

If no local payment schemes are available, you can also use amnis to conduct SWIFT transactions. Therefore, you have all the options available on one single platform, which streamlines your financial processes and reduces your foreign transaction costs significantly.

Debit cards and credit cards

Compared to bank transactions, card transactions enable you to make real-time cross-border payments through networks such as Mastercard or VISA. While a business debit card is directly linked to your bank account, deducting the purchase amount immediately from your funds, a credit card allows you to borrow money up to a credit limit.

amnis’ multi-currency debit card provides businesses with transparent and cost-efficient foreign transaction fees below the market average. Next to physical cards, you can instantly create virtual debit cards for immediate use.

amnis: International transactions made easy

amnis offers a financial ecosystem for businesses that not only facilitates international transactions, but also enables customers to benefit from local payment schemes such as SEPA or ACH, significantly reducing transaction costs and processing times.

Alongside its global payment network, amnis provides a business account with virtual debit cards and built-in expense management — giving you real-time visibility into spending, clear controls for teams, and a simple way to manage expenses and foreign transaction costs in one place.