Banking

Financial Ops

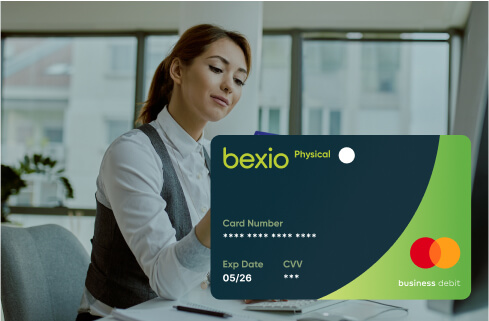

Expense Management

Automated, hassle-free accounting

Spend Control

Organize cards by regions or teams

Instant Alerts

Updates on accounts & transactions

FX Rate Alert

Daily & custom exchange rate alerts

Peer-to-Peer

Free supplier & intergroup payments

Multipay

Payment groups for recurring payments

Balance Cashback

Interest on safeguarded accounts

Cash Management

Finances on autopilot