All-in-one account for your global banking

Your powertool to cut international transaction costs, facilitate team spending, and save time on daily accounting tasks.

- CH-IBAN in the name of your company for local collections

- Free, local payments and collections in the UK, US, CH & EU

- Streamlined expenses with multi-currency debit cards

- 24/7 currency exchange at transparent rates

- Interest on safeguarded accounts in EUR, USD, GBP & CZK

Gain a competitive edge and explore all the benefits alongside 2,000+ satisfied companies.

Swiss innovation with extra tools for SMEs

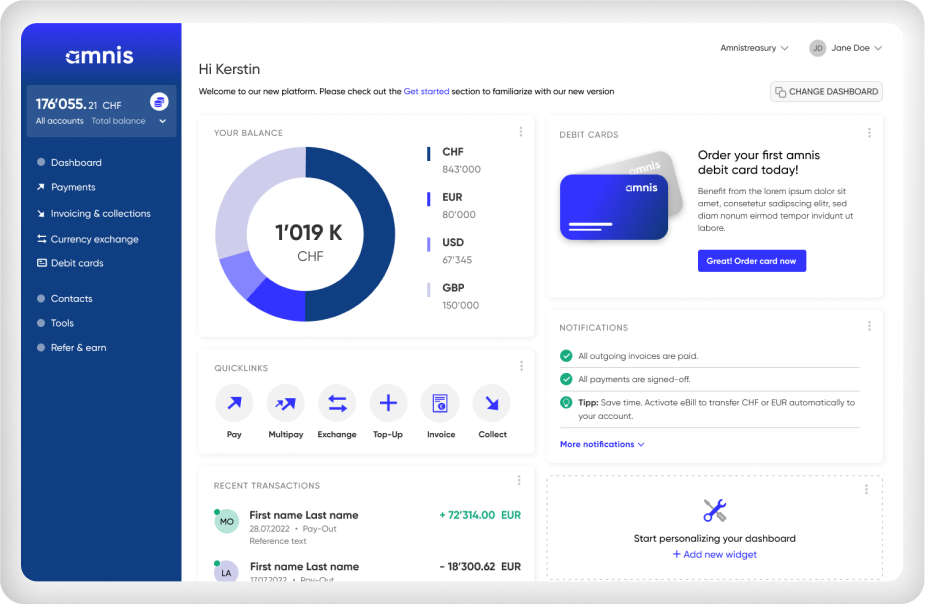

Experience the ease of managing your global payments and finances through one integrated tool. Bank-level security at a fraction of the cost.

Process one-time and recurring payments via local and cross-border payment rails at minimum cost, ensuring suppliers receive their full due amounts. Enjoy the added convenience of our multipay and file upload features, simplifying and accelerating mass payments.

Easily track the status and expected arrival time of your payments, similar to tracking parcels, and keep beneficiaries informed through our automated tracking system and public payment tracking links.

In a few clicks, set up virtual, domestic accounts under your company’s name for local payment collections in Europe, Switzerland, UK, USA and Canada and say goodbye to tedious paperwork! Manage foreign currency funds like a local, ensuring unparalleled payment convenience for your business partners.

One account, multiple currencies: simplify cross-border transactions (SWIFT) with a multi-currency IBAN in your company’s name. Effortlessly manage 20+ currencies through a single multi-currency account, streamlining account management while reducing administrative efforts.

On your terms: Execute spot, forward, and limit order transactions anytime through our user-friendly self-service tool, ensuring complete control with transparent processes and flat rates. Access exceptional local support if needed.

Managing cash in multiple currencies is now as easy as managing your email inbox: Just like setting rules to forward or categorize emails helps save time, automating your fx transactions with amnis allows you to streamline your financial workflows with ease.

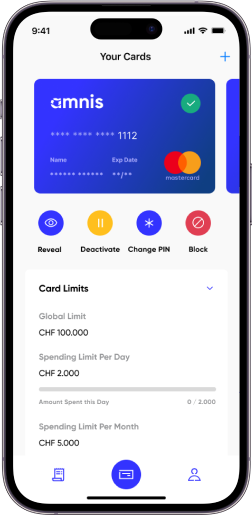

Instantly issue physical and virtual multi-currency cards for your employees online. Set customized limits, assign cards to teams, and monitor budgets with ease and on the go with our mobile app.

Easily tag and assign card transactions to projects or departments for comprehensive reports. Simplify expense management and bookkeeping by uploading receipts and importing transaction files into your accounting system.

Get your test account in 30 seconds. Activate any time.

In just 30 seconds, you get a free demo account to test our WebApp and compare rates, no obligations. Ready? Complete the account activation effortlessly in a few minutes – fully digital.

Get your test account

Complete the digital onboarding

Manage your payments efficiently

The innovative choice for your business’ global finances

A clear focus on SMEs allows us to tailor our platform to your needs and requirements – have a look for yourself.

WebApp

Platforms

Your account’s security is our priority

client funds

insurance

supervised

supervised

authentication

Unlocking global money transfers

Borderless currency transactions: Send money to over 200 countries and receive funds from 180+ countries through SWIFT. Maximize cost-efficiency with access to our network’s local payment rails.

2 billion +

101 currency

124 countries

4.8 stars

Navigating international banking: Tips & updates

Dutch Banks’ Foreign Exchange Comparison

(April 24)

Foreign exchange comparison: Dutch banks charge on average 1.14% for currency exchange Small and medium-sized companies (SMEs) are often unaware that high exchange rate mark-ups are hidden in the standard industry exchange rates. amnis is committed to transparent conditions and, thus, we regularly compare exchange rates by analyzing the fees included in banks’ foreign exchange […]

Benefits of using a company travel card for businesses

Domestic and international business travels have become standard among SMEs and corporations alike. Company travel cards are an integral part of a streamlined expense management strategy, as they increase efficiency and transparency while reducing unnecessary costs. We explain how a company debit card contributes to your expense management strategy and how it offers greater flexibility […]

What is a virtual debit card? Features to look for

Virtual business debit cards are the best option for SMEs and corporations alike due to benefits like: Instant activation Multiple currencies No hidden markups Lucrative packages Find out what features to look for and everything you need to know about your virtual debit card. What is a virtual debit card and how is it used? […]

See how it works

You’d like to test our international payment platform before opening a business account?

It only takes 30 seconds to get a demo account!